Previously W-2s went to. The three-year window of opportunity to claim a 2017 tax refund closes May 17 2021 for most taxpayers.

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Read customer reviews find best sellers.

. BE - Return Form of an individual resident who does not carry on a business the deadline is April 30. IRS Tax Deadline United States 2017. A copy of a IRS 1040 tax form is seen in Washington DC on December 22 2017 in Miami Florida.

1st Quarter 2017 Estimated Tax payment Due If you are self-employed or have other first-quarter income that requires you to pay quarterly estimated taxes get your Form 1040-ES postmarked by April 18 2017. The regular tax deadline in 2017 is April 18 2017. Taxpayers must either file a 2016 federal income tax return by this date or file a six-month automatic extension request by this date.

The deadline for paper or electronic filing 2017 Form 1099-MISC with Box 7 reporting with the Internal Revenue Service IRS is January 31 2018. 14 April 2016- Income tax due date for the CT61 for quarter to 31 March 2016. Ad Get Your Maximum Refund Guaranteed When You File With Americas 1 Tax Software.

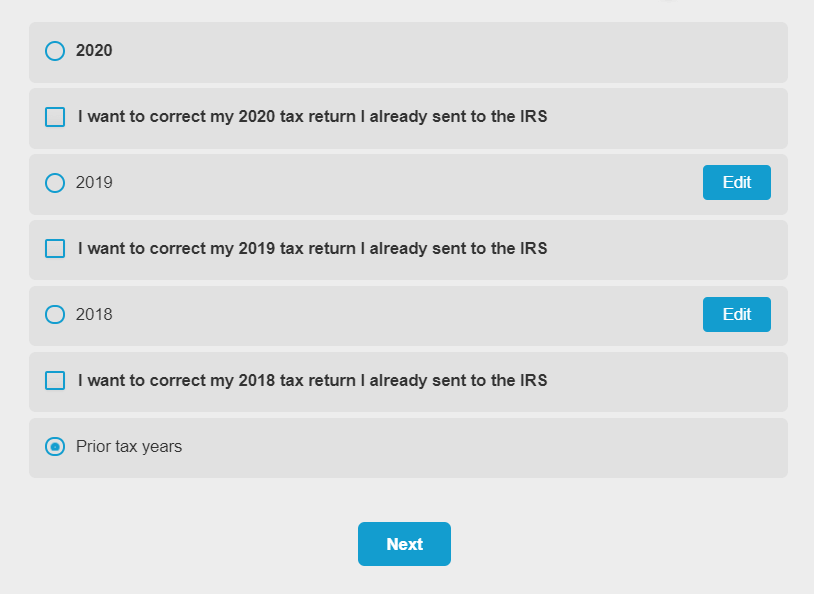

It must be postmarked by the May deadline. October 15th 2018 was the e-file and extension deadline. January 1st 2018 was the first day to start your tax return with PriorTax.

28-07-2017 Excise Duty payments. The last day to file in time to claim your money is May 17 2021. Simply The 1 Tax Preparation Software.

The deadline to file the 2017 tax return is October 15 2021 if you received an extension. A lot of important tax filing deadlines have changed in 2017 some by as much as a month. The regular tax deadline in 2017 is April 18 2017.

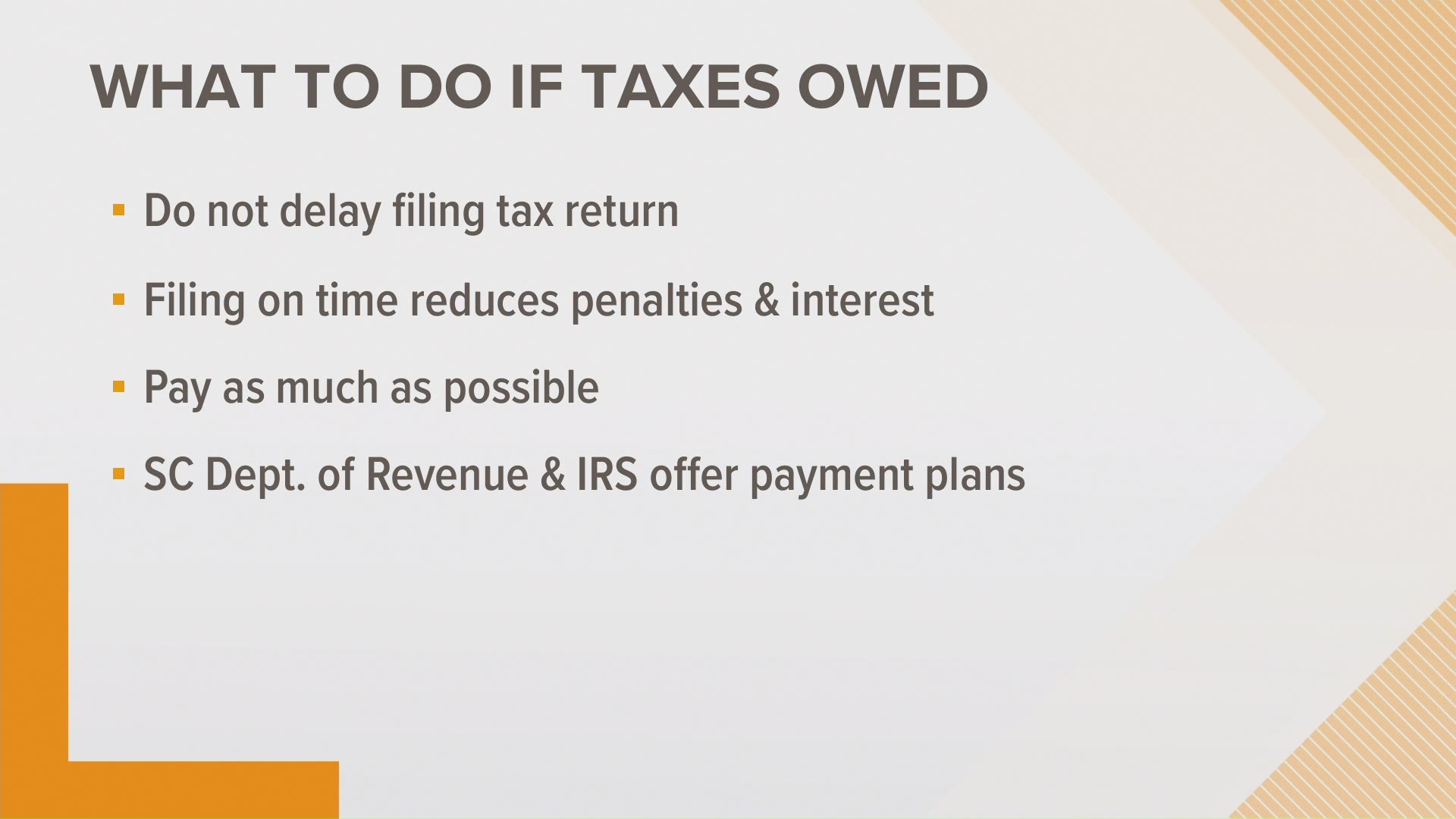

This is the transmittal form for W-2s. For taxpayers who havent filed their 2017 tax returns this is the last chance to claim the money theyre due before this years federal filing deadline also known as Tax Day which is May 17 2021. What is the deadline for 2017 tax returns.

62017 Date Of Publication. Try It Yourself Today. If youre late on filing your 2017 taxes you still have time to do so.

Select your state s and click on any of the state form links and complete sign the form. Recipient Deadline for 1099 Tax Reporting The deadline for submitting 2017 Form 1099s to recipients is January 31 2018. 25-07-2017 VAT manual submissions and payments.

Last Day to make a 2016 IRA Contribution. January 29th 2018 marks the first day you can e-file your 2017 tax return. For tax year 2017 Federal income tax returns the normal April 15 deadline to claim a refund has been postponed to May 17 2021.

7 April 2016- Due date for submission of VAT Return and payment of any outstanding liability for the quarter ending 29 February 2016. Tuesday April 18. You can complete and sign the forms online.

Ad Browse discover thousands of brands. Taxpayers must either file a 2016 federal income tax return by this date or file a six-month automatic extension request by this date. The mailing address is listed on the 1040 Form for any given tax year.

19 April 2016- Quarterly PAYENIC due for year ended 5 April 2016. April 17th 2018 was the last day to file your individual federal and state tax returns or extensions without IRS penalties accumulating. Those who filed for an extension can skip late penalties by.

If they do not file a tax return by May 17 the money becomes the property of the US. Our Powerful Software Makes it Easy to Prepare and File Even for Late Taxes. It will be the last day to file 2017 taxes for a refund.

100s of Top Rated Local Professionals Waiting to Help You Today. 31-07-2017 VAT electronic submissions and payments. Credit for Federal Tax on Fuels.

The law requires taxpayers to properly address and mail the tax return to the IRS. 15 to submit their extended return originally due on May 17. However the IRS.

The IRS may hold the 2017 refunds of taxpayers who have not filed tax returns for 2018 and 2019. The IRS estimates 13 million taxpayers did not file a 2017 tax return to claim tax refunds worth more than 13 billion. Self-employed workers who pay quarterly estimated tax must pay their first-quarter tax payment for 2017 by this deadline.

When done select one of the save options given. Filers have until Oct. Form 1096 is the transmittal form used to submit your 1099s to the IRS with.

You can also file returns for 2018 and 2019 for a refund at the same time. 07-07-2017 PAYE submissions and payments. The law under Internal Revenue Code 6511 generally provides a three-year window of opportunity to claim a refund from the time the tax return was filed or two years from the time the tax was paid whichever is later.

Weve condensed all the 2017 Tax returns VAT and PAYE submission due dates and deadlines to watch out for here below. The law provides a three-year window of opportunity to claim a refund. File your request for a tax extension by April 18 to push your deadline back to October 17 2017.

The tax extension deadline for 2020 returns is approaching but theres still time to avoid extra penalties and fees. The government and employees now all need copies of Forms W-2 by January 31. In order to file a 2017 IRS Tax Return click on any of the form links below.

The deadline for filing individual tax returns is later than usual this yearMonday May 17. Register for Self Assessment if youre self-employed or a sole trader not self-employed or registering a partner or partnership. 6 April 2016- Start of 20162017 tax year.

Malaysias personal income tax year is from 1 January to 31 December and income is assessed on a current year basis. This is also the deadline to submit an amended tax return for 2013 and. Ad Step-by-step guidance to help you quickly prepare and file your 2021 tax return.

As a result of federal legislation enacted in 2015 1 several federal tax returns and tax related forms will have different filing dates beginning in 2017While the due date for an individuals federal tax return Form 1040 generally remains April 15 the 2017 due date is actually April 18 2017 2 the due dates for filing federal tax returns of various business. For the tax year 2017 Federal income tax returns the normal April 15 deadline to claim a refund has also been extended to May 17 2021. For 2017 tax returns the three-year window closes May 17 2021.

5 Mailing Or Delivery Service Tips For Paper Tax Return Filers Don T Mess With Taxes

What Are The Two Options Singapore Companies Have When Filing Their Tax Returns What Is The Difference Between Form C And Fo Tax Return Singapore Filing Taxes

When Are Taxes Due In 2017 Not April 15 Money

Tax Return Copies Can Be Downloaded From Efile Com Account

Remember Some Tax Return Due Dates Are Different In 2017

When Are Taxes Due In 2022 Forbes Advisor

Southside School Completed In 1969 By Industrial Designer And Architect Eliot Noyes Instagram Photo By Exhibit Columbus Southside Columbus Indiana Columbus

Us Tax Filing 2022 For 2021 H1b L1 H4 L2 Updates Deadline Rates E Filing Redbus2us

Due Date To File Income Tax Return Ay 2017 18 Fy 2016 17 Simple Tax India Income Tax Income Tax Return Tax Return

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

How To File Back Taxes On F J M Q Visas Filing Prior Year Tax Returns

Tax Returns Due May 17 Last Day To File Taxes Without Penalty 13newsnow Com

3 15 Deadline To Claim 2017 Refund 4 15 For 2017 Social Security Earnings Philadelphia Legal Assistance

Tax Returns Due May 17 Last Day To File Taxes Without Penalty 13newsnow Com

3 15 Deadline To Claim 2017 Refund 4 15 For 2017 Social Security Earnings Philadelphia Legal Assistance

Tax Filing Deadline Approaches Http Cookco Us News Tax Filing Deadline Approaches Filing Taxes Tax Filing Deadline How To Be Outgoing

The Tax Deadline Is May 17 Make These Moves Before You File Forbes Advisor

Irs Notice Cp22a Changes To Your Form 1040 H R Block